This article was originally published by Artis Shepherd at The Mises Institute.

Berkshire Hathaway—the investment holding company run by Warren Buffett for the last sixty years—released its much-awaited annual report in late February. In the report, Buffett himself delved into the topic of capitalism and America’s relationship thereto. Early in the preamble to the report, Buffett hints at the connection between inflation and government malfeasance:

Paper money can see its value evaporate if fiscal folly prevails. In some countries, this reckless practice has become habitual, and, in our country’s short history, the U.S. has come close to the edge. Fixed-coupon bonds provide no protection against runaway currency.

Soon after, he follows up by describing a necessary function of capitalism within a broader economy:

…deployment of savings by citizens is required to propel an ever-growing societal output of desired goods and services. This system is called capitalism. It has its faults and abuses—in certain respects more egregious now than ever—but it also can work wonders unmatched by other economic systems.

In these two instances, Buffett has recognized the harm that fiat money causes when controlled by bureaucrats while vaguely describing the proper form that wealth creation takes, namely, individual choice and action towards saving—and the appropriate deployment of that saving towards productive investment—rather than consumption. Buffett is clearly and correctly stating that wealth can’t be created by printing money, but it is created through the process of savings and subsequent capital allocation. Subsequently, he points out kinks in the “American process,” apparently conflating this phrase with “capitalism,”

The American process has not always been pretty – our country has forever had many scoundrels and promoters who seek to take advantage of those who mistakenly trust them with their savings. But even with such malfeasance – which remains in full force today – and also much deployment of capital that eventually floundered because of brutal competition or disruptive innovation, the savings of Americans has delivered a quantity and quality of output beyond the dreams of any colonist.

Before diving into business matters, Buffett finishes off the preamble with the following, a reference to prior discussion in the preamble that points out—proudly and loudly—Berkshire’s cumulative federal tax payments of $101 billion, more than any American corporation:

Berkshire would not have achieved its results in any locale except America whereas America would have been every bit the success it has been if Berkshire had never existed…So thank you, Uncle Sam. Someday your nieces and nephews at Berkshire hope to send you even larger [income tax] payments than we did in 2024. Spend it wisely. Take care of the many who, for no fault of their own, get the short straws in life. They deserve better. And never forget that we need you to maintain a stable currency and that result requires both wisdom and vigilance on your part.

Analysis of Buffett’s reports is always instructive. He has, for decades, been a fount of investing wisdom and common sense. Exceedingly rarely, if ever, has he succumbed to speculative fads, preferring rational approaches to capital allocation that seem quaint today in the era of memecoins and trillion-dollar market cap companies that make zero business profits. Throughout the many booms and busts during his tenure at Berkshire, Buffett’s investment philosophy—influenced by people like Benjamin Graham—has remained steadfast and sensible.

Given this context, what is one to make of his seemingly conflicting remarks on capitalism—the “American process”—and taxation?

Blinded by the Light

A charitable interpretation of Buffett’s comments about “Uncle Sam,” and his pride in Berkshire’s paying over a hundred billion dollars in income tax, is that he confuses context with causation. Having grown up—and succeeded immensely—in the post-World War II system, Buffet incorrectly attributes his and America’s success to that system. He seems to conflate “America” with the government.

But on cursory examination, his premises are woefully incorrect. The US made its biggest civilizational advances during the latter half of the Victorian era and into the Edwardian era—a period spanning roughly 1870-1910. During this time, the US had sound money in the form of a strong gold standard shared with most developed nations. It had no income tax, no central bank, no welfare state, and—compared to the 20th century—eschewed international entanglements.

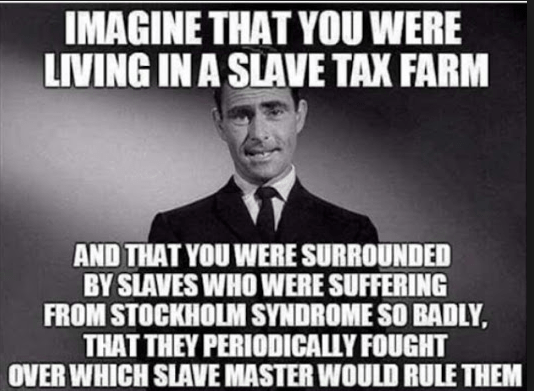

This was not only an economically fruitful state of affairs, it was also moral. As Buffett no doubt knows but chooses to ignore, taxation is an immoral and criminal expropriation of productive citizens by the government. It involves no legal contract and no provision of services—only the destruction of economic work product and personal motivation. It is a figurative (and sometimes literal) gun to the head of US citizens. Bragging about being the most prolific taxpayer is deranged, and whiffs of severe Stockholm Syndrome.

Further, a couple of the supposed faults and abuses of capitalism are identified, albeit indirectly, by Buffett as misallocation of capital and proliferation of scam artists. Yet these are precise outcomes of fiat money and a social-democratic regime that de-prioritizes personal property at the expense of government stewardship and redistribution. Economists of the Austrian School have, for over a century, identified malinvestment and high time preference as two direct results of unsound money under the control of a bureaucracy. If misallocation of capital is indeed a concern, Buffett may want to tamp down his cheerleading of the welfare state and read Hayek or von Mises before his next annual letter. (Remember that Warren Buffett’s father—Howard Buffet—read and corresponded with Murray Rothbard).

Lastly, Buffett’s warning about paper money is misplaced. One cannot simultaneously bemoan the loss of value in paper money and ask the money printers—who benefit directly from said printing—to apply discipline. This is like asking the arsonist to fireproof your home. The fiat money system that forms Buffett’s personal context has apparently warped his ability to synthesize economic and monetary history while softening his critical faculties against its planners and enablers.

Sound Money Derangement Syndrome

Warren Buffett may belie his stated beliefs. In terms of his actions, a strong case can be made that he is a pure capitalist, inspired by Austrian economics. His exhibited low time preference demonstrates that. Nevertheless, Keynesian talking points—support of deranged and immoral politicians—and an unwillingness to criticize the fiat money system that explicitly harms the average American, with which Buffett claims to be concerned, are unfortunate qualities of this otherwise great investor.

Read the full article here