Posted on Monday, March 3, 2025

|

by Shane Harris

|

0 Comments

|

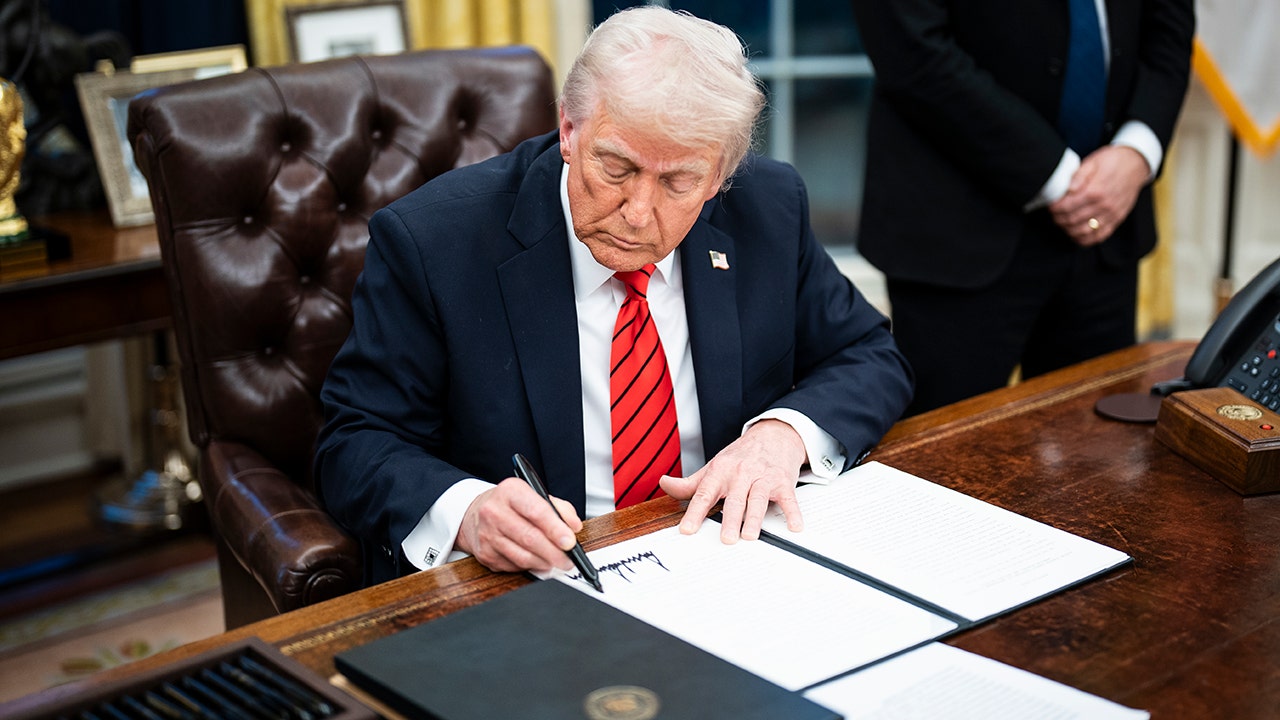

The Trump Treasury Department announced this week that it will not enforce any fines or penalties associated with reporting requirements under the Corporate Transparency Act (CTA), delivering a major victory for some 32 million small business owners nationwide.

The department wrote in an X thread on Sunday that “not only will it not enforce any penalties or fines associated with the beneficial ownership information reporting rule under the existing regulatory deadlines [of the CTA], but it will further not enforce any penalties or fines against U.S. citizens or domestic reporting companies or their beneficial owners after the forthcoming rule changes take effect either.”

Treasury Secretary Scott Bessent called the move “a victory for common sense” and said it was “part of President Trump’s bold agenda to unleash American prosperity by reining in burdensome regulations, in particular for small businesses that are the backbone of the American economy.”

In a post on Truth Social, President Trump called the CTA’s reporting requirements “outrageous and invasive” and “an economic menace,” adding that the Biden administration’s enforcement of the law “has been an absolute disaster for small businesses nationwide.”

Passed as part of the 2021 National Defense Authorization Act (NDAA), the CTA was enacted despite President Trump’s veto, which Congress overrode to install this sweeping federal mandate. Under the pretense of combating financial crimes, the CTA compels millions of small businesses to disclose sensitive personal information to the Financial Crimes Enforcement Network (FinCEN) or face steep fines and even jail time.

In theory, the CTA applies to all businesses that operate in the United States. But loopholes and special carve-outs allow large corporations to avoid disclosures – meaning that the regulatory burden falls disproportionately on everyday entrepreneurs. Large companies can still use foreign entities (like shell corporations) that are not subject to the same regulations as domestic businesses, allowing them to shield their ownership from both U.S. authorities and the CTA’s disclosure requirements.

Rather than focusing on real financial criminals, the CTA treats every small business owner like a suspect, stripping states of their long-held regulatory authority and consolidating even more power in Washington. Worse, the CTA creates a massive federal database of personal information – which can be accessed without a judicial warrant – raising serious privacy and cybersecurity concerns, as FinCEN has suffered repeated breaches in the past.

Moreover, many small businesses lack the resources for dedicated legal or accounting teams and must hire outside professionals to meet the CTA’s requirements. Beyond initial filing costs, businesses must also bear ongoing expenses for updating ownership information, creating a recurring burden. As one user posted on X in response to the news, “I spent $350 to comply with this crap. Where do I send my invoice to be compensated?”

The threat of steep fines and penalties for non-compliance further exacerbates the financial risk, potentially driving small businesses to close or scale back operations. Ultimately, the CTA’s complex requirements and financial penalties stifle entrepreneurship, imposing burdens on those least equipped to handle them.

Despite these concerns, the bill was enacted with overwhelming bipartisan support in both chambers of Congress. Although some Republicans, including Rep. Thomas Massie (KY) and Senators Rand Paul (KY) and Mike Lee (UT) voiced their opposition, the 2021 NDAA ultimately passed by a vote of 335 to 78 in the House and 84 to 13 in the Senate.

Since then, the CTA has faced significant legal challenges, particularly regarding its privacy implications and the scope of its requirements. While some lawsuits have contested the federal government’s authority to impose the CTA’s regulations, courts have largely upheld the law. In January, the Supreme Court issued a ruling overturning a lower court order temporarily blocking implementation of the CTA.

Now, however, the Trump administration has effectively neutralized the law by announcing that businesses won’t be punished for violating it.

The move is sure to elicit plenty of outrage from Democrats and a corporate media always eager to jump on any opportunity to portray the Trump administration as overly friendly to big business. Liberals will surely spin it as an effort to shield tax cheats and financial criminals from transparency and accountability.

But the reality of the CTA is that, much like gun control laws, it was only ever going to hurt legal, law-abiding business owners while doing little to punish criminals. If large corporations can get around the CTA’s disclosures simply to avoid the annoyance of filing them, then criminals can surely avoid them as well.

Notably, the Treasury Department also said that it will “further be issuing a proposed rulemaking that will narrow the scope of the rule to foreign reporting companies only.” It’s a policy that’s perfectly in line with Trump’s “America First” agenda – cut burdensome regulations for American citizens while still placing a high burden of entry on foreign entities that want access to the U.S. economy.

While the Trump administration’s move provides expedited relief for small businesses, however, that relief may only be temporary. The most permanent solution to the CTA would be repealing the law altogether. In January, Rep. Warren Davidson (R-OH) and Senator Tommy Tuberville (R-AL) re-introduced the “Repealing Big Brother Overreach Act” to do just that.

Nonetheless, the Trump administration’s announcement is a step in the right direction. Small business owners can all breathe a sigh of relief.

Shane Harris is the Editor in Chief of AMAC Newsline. You can follow him on X @shaneharris513.

Read the full article here