Tax season is done.

And this year, Congressional Republicans converted tax season to “sales” season. Republicans and President Donald Trump are pushing to approve a bill to reauthorize his 2017 tax cut package. Otherwise, those taxes expire later this year.

“We absolutely have to make the tax cuts permanent,” said Rep. Tom Tiffany, R-Wis., on FOX Business.

“We’ve got to get the renewal of the President’s Tax Cuts and Jobs Act. That’s absolutely essential,” said Sen. Mike Rounds, R-S.D., on FOX Business.

Rates for nearly every American spike if Congress doesn’t act within the next few months.

CONFIDENCE IN DEMOCRATS HITS ALL TIME LOW IN NEW POLL

“We are trying to avoid tax increases on the most vulnerable populations in our country,” said Rep. Beth Van Duyne, R-Texas, a member of the House Ways and Means Committee which determines tax policy. “I am trying to avoid a recession.”

If Congress stumbles, the non-partisan Tax Foundation estimates that a married couple with two children – earning $165,000 a year – is slapped with an extra $2,400 in taxes. A single parent with no kids making $75,000 annually could see a $1,700 upcharge on their tax bill. A single parent with two children bringing home $52,000 a year gets slapped with an additional $1,400 in taxes a year.

“Pretty significant. That’s an extra mortgage payment or extra rent payment,” said Daniel Bunn of the non-partisan Tax Foundation. “People have been kind of used to living with the policies that are currently in law for almost eight years now. And the shift back to the policy that was prior to the 2017 tax cuts would be a dramatic tax increase for many.”

But technically, Republicans aren’t cutting taxes.

“As simple as I can make this bill. It is about keeping tax rates the same,” said Sen. James Lankford, R-Oklahoma, on Fox.

Congress had to write the 2017 tax reduction bill in a way so that the reductions would expire this year. That was for accounting purposes. Congress didn’t have to count the tax cuts against the deficit thanks to some tricky number-crunching mechanisms – so long as they expired within a multi-year window. But the consequence was that taxes could climb if lawmakers failed to renew the old reductions.

“It sunsets and so you just automatically go back to the tax levels prior to 2017,” said Sen. Chuck Grassley, R-Iowa.

A recent Fox News poll found that 45% of those surveyed – and 44% of independents believe the rich don’t pay enough taxes.

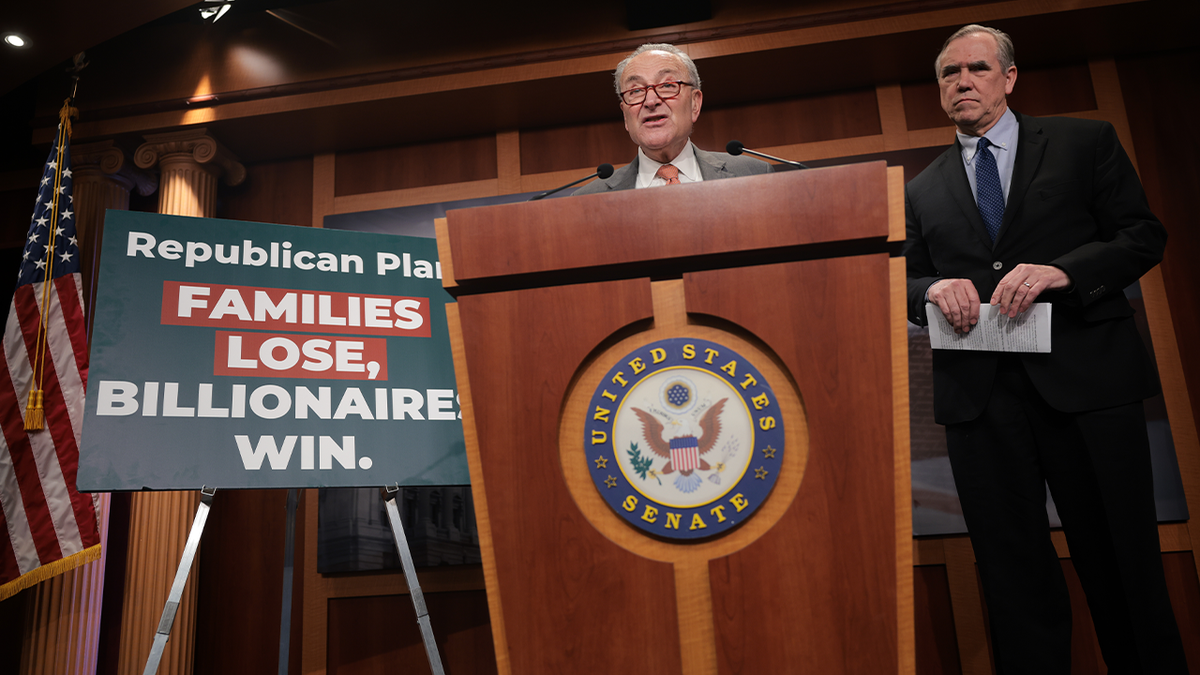

Democrats hope to turn outrage about the perceived tax disparity against Trump.

“He wants his billionaire buddies to get an even bigger tax break. Is that disgraceful?” asked Senate Minority Leader Chuck Schumer, D-N.Y., at a rally in New York.

“Disgrace!” shouted someone in the crowd.

“Disgraceful! Disgraceful!” followed up Schumer.

Some Republicans are now exploring raising rates on the wealthy or corporations. There’s been chatter on Capitol Hill and in the administration about exploring an additional set of tax brackets.

“I don’t believe the president has made a determination on whether he supports it or not,” said White House spokeswoman Karoline Leavitt.

“We’re going to see where the President is” on this, said Treasury Secretary Scott Bessent while traveling in Argentina. “Everything is on the table.”

A Treasury spokesperson then clarified Bessent’s remarks.

“What’s off the table is a $4.4 trillion tax increase on the American people,” said the spokesperson. “Additionally, corporate tax cuts will set off a manufacturing boom and rapidly grow the U.S. economy again.”

Top Congressional GOP leaders dismissed the idea.

“I’m not a big fan of doing that,” said House Speaker Mike Johnson on Fox. “I mean we’re the Republican party and we’re for tax reduction for everyone.”

FEDERAL JUDGE TEMPORARILY RESTRICTS DOGE ACCESS TO PERSONALIZED SOCIAL SECURITY DATA

“I don’t support that initiative,” said House Majority Leader Steve Scalise, R-La., on FOX Business, before adding “everything’s on the table.”

But if you’re President Donald Trump and the GOP, consider the politics of creating a new corporate tax rate or hiking taxes on the well-to-do.

The president has expanded the GOP base. Republicans are no longer the party of the “wealthy.” Manual laborers, shop and storekeepers and small business persons now comprise Trump’s GOP. So maintaining these tax cuts helps with that working-class core. Raising taxes on the wealthy would help Republicans pay for the tax cuts and reduce the hit on the deficit. And it would shield Republicans from the Democrats’ argument that the tax cuts are for the rich.

Congress is now in the middle of a two-week recess for Passover and Easter. GOP lawmakers and staff are working behind the scenes to actually write the bill. No one knows exactly what will be in the bill. Trump promised no taxes on tips for food service workers. There is also talk of no taxes on overtime.

WHITE HOUSE PHOTO BLUNTLY SHOWS WHERE PARTIES STAND ON IMMIGRATION AMID ABREGO GARCIA DEPORTATION

Republicans from high-tax states like New York and Pennsylvania want to see a reduction of “SALT.” That’s where taxpayers can write off “state and local taxes.” This provision is crucial to secure the support of Republicans like Reps. Nicole Malliotakis, R-N.Y., and Mike Lawler, R-N.Y. But including the SALT reduction also increases the deficit.

So what will the bill look like?

“Minor adjustments within that are naturally on the table,” said Rounds. “The key though, [is] 218 in the House and 51 in the Senate.”

In other words, it’s about the math. Republicans need to develop the right legislative brew which commands just the right amount of votes in both chambers to pass. That could mean including certain provisions – or dumping others. It’s challenging. Especially with the slim House majority.

“There were trade-offs and offsets within that bill that many people are dissatisfied with,” said Bunn of the 2017 bill. “And it’s not clear how the package is going to come together with those various trade-offs.”

Johnson wants the bill complete by Memorial Day. Republicans know this enterprise can’t drag on too late into the year. Taxpayers would see a tax increase – even if it’s temporary – if working out the bill stretches into the fall when the IRS begins to prepare for the next tax season.

It’s also thought that finishing this sooner rather than later would provide some stability to the volatile stock markets. Establishing tax policy for next year would calm anxieties about the nation’s economic outlook.

“The big, beautiful bill,” Trump calls it, adding he wants the legislation done “soon.”

And that’s why tax season is now sales season. Both to the lawmakers. And to the public.

Read the full article here