The world’s largest stablecoin issuer is taking steps to reshape its image in the U.S. as it faces continued scrutiny over its business practices.

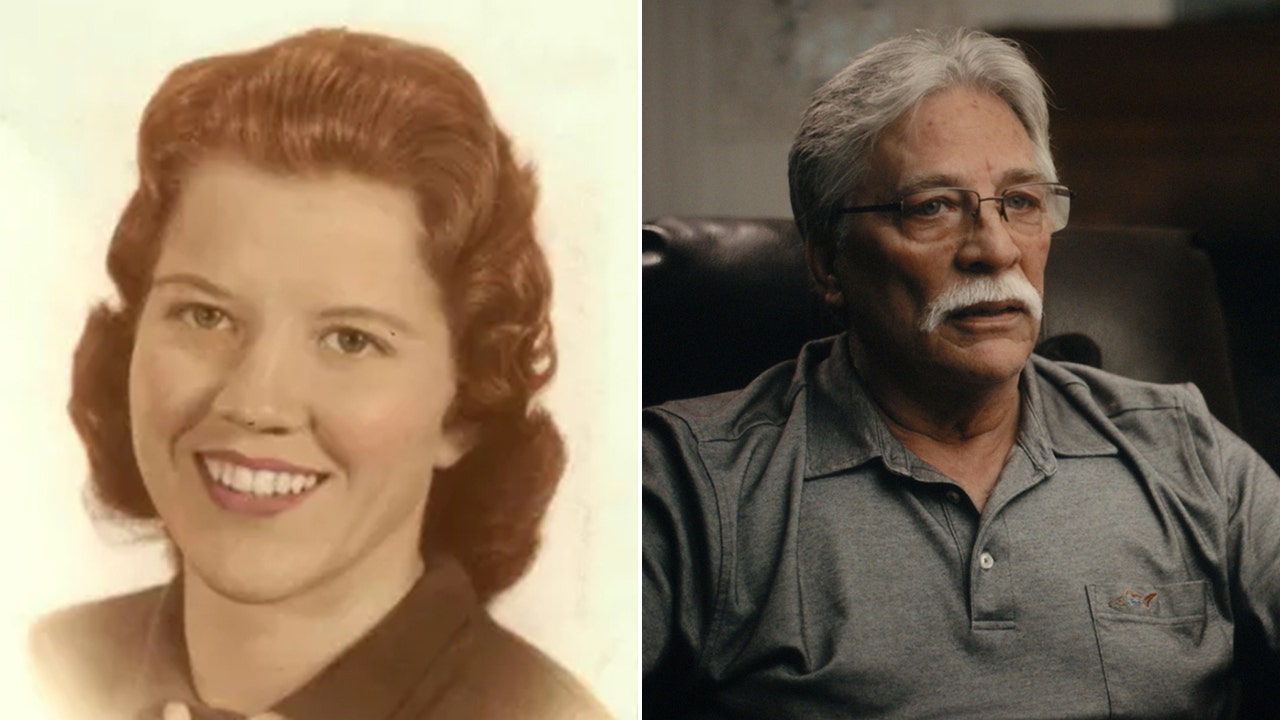

The head of the global firm behind the most widely used dollar-backed crypto token, USDT, and which holds an astounding $97 billion in U.S. government bonds, gave a rare interview with FOX Business and addressed widespread criticism regarding an alleged lack of transparency surrounding the company’s reserve assets and concerns about its business practices.

Tether CEO Paolo Ardoino also outlined how the 10-year-old company, which is celebrating its decade anniversary this month, is focusing on revitalizing its brand. This effort includes partnerships with U.S. law enforcement agencies, a growing relationship with broker-dealer Cantor Fitzgerald and its CEO Howard Lutnick, and strategic investments in emerging technologies.

“Part of my role as CEO has been to try to actually showcase the work we are capable of and what we are doing,” said Ardoino, who took over the top job in 2023 after serving six years as the company’s chief technology officer. “For example, we now collaborate with more than 180 law enforcement agencies across 45 different jurisdictions.”

Some of those collaborations include the FBI, the Secret Service and the Department of Justice, the latter recently acknowledging Tether for its assistance in freezing illicit funds. Last month, Tether announced it had partnered with two other crypto firms, Tron and TRM Labs, to create a surveillance task force dedicated to fight financial crime tied to Tether’s stablecoin USDT.

CRYPTO ASSET MANAGER BITWISE FILES FOR FIRST XRP EXCHANGE-TRADED FUND

“We have 350 million users of our stablecoin worldwide,” Ardoino said, pointing out that most users live in developing countries who buy USDT as a hedge against their countries’ weak monetary systems and debased currencies. “People are sick and tired of being subject to poor decisions from their governments in terms of monetary policies,” he added. “We need to make sure that our ecosystem remains safe so we can continue to help them.”

One of the biggest criticisms Tether has received over the years is its stablecoin’s use in illicit finance schemes such as money laundering, ransomware payments and transactions on the dark web. The firm has faced allegations that it is enabling entities in sanctioned countries like North Korea, Russia and Iran to bypass traditional financial systems and enable crime like terrorism and human trafficking.

This summer, Tether became the subject of a multimillion-dollar ad campaign by the nonprofit activist group Consumers Research. The campaign featured digital billboards in New York City’s Times Square, TV ads and fliers handed out to members of Congress accusing the company of corruption.

Ardoino, who has not publicly addressed the campaign until now, admits Tether has been naïve by failing to adequately address these concerns publicly in the past, noting that the company did not establish a public relations team until 2022.

“I feel sad just because it’s a misrepresentation of a technology and a company that is helping hundreds of millions of people,” Ardoino said. “We’re putting our faces out there, we work with law enforcement and we respect the OFAC SDN list. So, I sleep very well being proud of what we built, and I can look at myself in the mirror despite these smear campaigns.”

In its recent efforts to combat bad actors, Tether has blocked more than $1.8 billion USDT from over 1,850 crypto wallets, 636 of which were coordinated with U.S. agencies.

Investing in Emerging Markets and Technologies

As the global adoption of dollar-backed stablecoins continues to rise, the overall stablecoin market has surged to approximately $160 billion, with Tether experiencing a significant acceleration in profits. The firm reported a profit of $6.2 billion in 2023, surpassing that of the world’s largest asset manager, BlackRock, which posted $5.5 billion. In the first half of 2024 alone, Tether generated $5.2 billion in profit, some of which is being reinvested into emerging technologies like AI infrastructure – an area Ardoino believes has become too monopolized by big tech companies.

“One of the reasons why we invested in AI infrastructure is because we wanted to give an opportunity to companies to have access to quality infrastructure that is basically independent, not held by one of the big tech companies,” he said. “We also believe in the importance of supporting the territories that we operate in from payments to other ventures.”

GRAYSCALE TO LAUNCH FIRST US XRP TRUST, PAVING WAY FOR POTENTIAL ETF

Tether has invested in a range of startups across a variety of industries, including bitcoin mining company Bitdeer, which lists on the Nasdaq, and Utah-based startup Blackrock Neurotech (not affiliated with asset manager BlackRock), which develops brain chip technology to help people with neurological disorders such as ALS more effectively communicate.

From the roughly $12 billion of company profits made over the last two years, Ardoino notes that roughly half has been set aside in a separate account for investing, while the other six have been put toward its USDT reserves.

“USDT is now around 104% backed,” he said. “Usually, you have banks that are doing fractional reserves. We are over-collateralized, and our highest priority is keeping the stablecoin safe.”

USDT Reserves

Tether’s reserves have long been a source of controversy, with the broader crypto industry criticizing the company for its previous lack of transparency and auditing. As a stablecoin, Tether’s tokens are pegged to the U.S. dollar, and the company asserts that all $119 billion worth of USDT tokens in circulation are fully backed one-to-one by dollar reserves. However, since Tether is not based in the U.S. and conducts most of its business offshore, it has never undergone a full audit by a U.S. accounting firm, fueling skepticism about the true state of its reserves.

Investigations by the New York attorney general and the Commodity Futures Trading Commission found that Tether had in the past misrepresented the backing of its USDT, finding its reserves were not always fully collateralized as the firm had claimed. It also revealed that Tether’s sister company, crypto exchange Bitfinex, had at one point been using Tether’s reserves to cover its own financial shortfalls, leading to further uncertainty over its financial situation.

As part of its settlement with the New York attorney general, Tether agreed to submit quarterly reports on its reserves for two years. The firm now uses the Italian arm of global auditor BDO to produce quarterly attestations of its stablecoin reserves. As of Aug. 1, BDO reported that Tether had $118.4 billion in reserves and $5.3 billion in excess reserves. Tether also now publishes daily reports on its website that detail the amount of Tether in circulation and the amount of USD reserves held by the company.

However, Tether has never had a full audit done, even by BDO, as its quarterly attestations do not qualify as systematic examinations of the whole company and its financial statements.

FORMER SOLICITOR GENERAL PAUL CLEMENT JOINS COINBASE BOARD

Another voucher for Tether’s reserves is Howard Lutnick, the CEO of Cantor Fitzgerald and a crypto enthusiast, who, Ardoino says, spent close to two years going through Tether’s books to see whether it had the assets it claims.

“From what we’ve seen, and we did a lot of work, they have the money they say they have,” Lutnick said earlier this year, adding that Cantor manages many of Tether’s assets, including its hefty portfolio of short-term U.S. Treasury bills.

Tether is now the 18th largest holder of U.S. debt with $97 billion worth on its books, according to the company. Ardoino says Tether’s decision to buy up U.S. Treasurys was primarily to ensure that the company can handle large redemption events and debt repayments efficiently.

“We grew at the level where we needed a partner like Howard and the company Cantor to hold our U.S. Treasurys,” Ardoino said. “Cantor has a direct connection with the Fed, which means that no matter what, we can easily pay out through that facility.”

“If you look at everything in the market, there is nothing that is as safe, as protected, as guaranteed, as the short-term USD bills,” he added, noting the company’s shift away from holding commercial paper in its reserves.

While backing USDT with U.S. Treasurys may put some minds at ease, others worry that Tether’s owning of so much government debt puts it at higher risk in the event of rising interest rates. A sudden rise in rates could lead to a decline in the value of Tether’s Treasury holdings, potentially putting strain on its ability to meet redemption requests. This has only strengthened calls for Tether to submit to an audit by one of the “Big Four” U.S. accounting firms – Deloitte, KPMG, Ernst and Young and PricewaterhouseCoopers.

Ardoino says that he would be open to having an audit done by one of them, but points to the unfriendly regulatory environment under the current administration, with regulators and anti-crypto lawmakers (he mentions Massachusetts Sen. Elizabeth Warren), making it difficult for auditors to take on crypto firms as clients, particularly ones outside the U.S.

He hopes the outcome of the U.S. election in November will help change regulators’ attitudes toward the burgeoning digital asset market.

“When I was a kid, I remember how the U.S. was king of every new technology and any new discovery, and basically everything,” said Ardoino, who was born and raised in Italy. “And I feel like for the first time in history, at least that I can remember, the U.S. has dropped the ball on probably one of the most revolutionary technologies of our time.”

Read the full article here