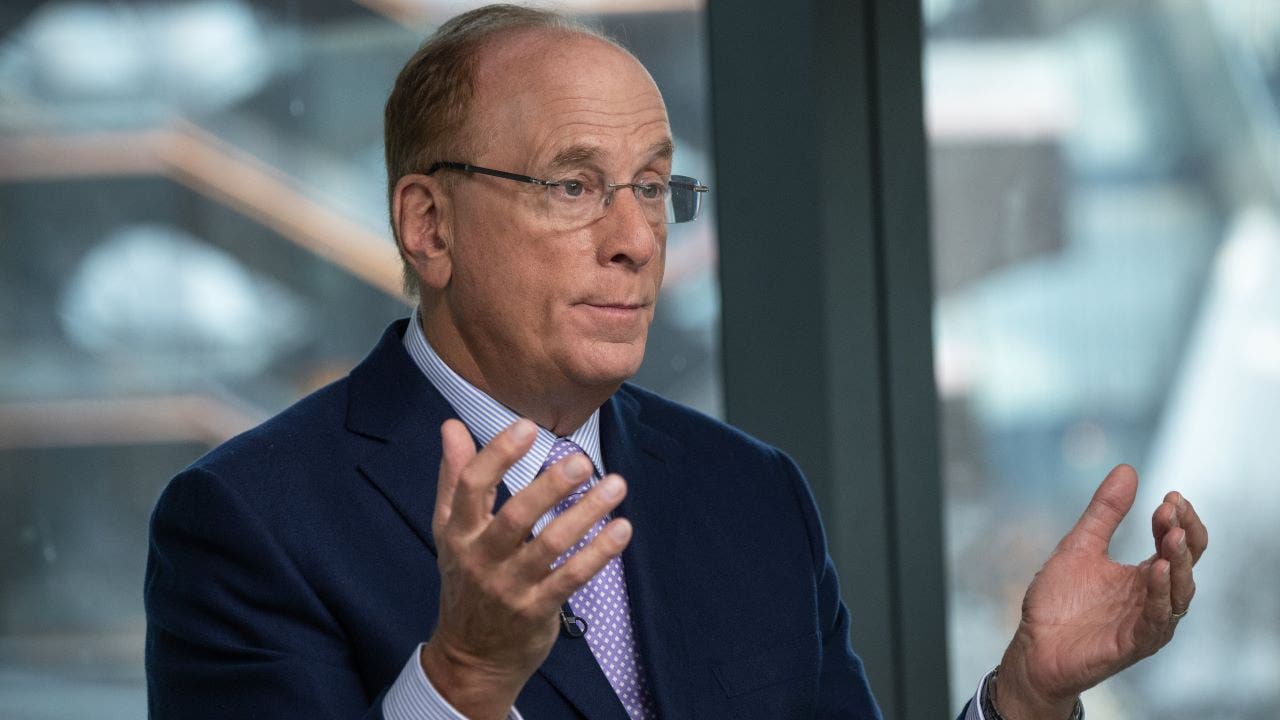

BlackRock CEO Larry Fink said Tuesday he does not believe the Federal Reserve will cut interest rates as much as some analysts expect, due to “embedded” inflation.

During a roundtable at the annual Future Investment Initiative (FII) in Saudi Arabia, the head of the world’s largest asset manager was asked how much he sees the central bank cutting rates by the end of 2024.

“It’s fair to say we’re going to have at least a 25 (basis point cut), but that being said, I do believe we have greater embedded inflation in the world than we’ve ever seen,” Fink said.

The Fed slashed rates by 50 basis points in September, lowering the benchmark federal funds rate for the first time in four years to a range of 4.75% to 5%. Following the cut, JPMorgan analysts forecasted another two rate cuts by the central bank by the end of this year, with further cuts throughout 2025.

GOP SENATOR EXPLAINS HOW INFLATION ‘HITS SENIORS PARTICULARLY HARD’ UNDER DEMOCRATS

The Labor Department reported inflation cooled in September to the lowest level in three years, though it came in slightly hotter than expected, with the consumer price index rising 2.4% from a year ago.

Overall, the report showed signs that inflationary pressures in the U.S. economy are continuing to ease, though prices remain above the Fed’s 2% target.

High inflation has created severe financial pressures for most U.S. households, which are forced to pay more for everyday necessities like food and rent.

MORE AMERICANS LIVING PAYCHECK TO PAYCHECK THAN 5 YEARS AGO, BANK OF AMERICA DATA SHOWS

“We have government and policy that is much more inflationary – whether it’s immigration, our policies of on-shoring – all of this, no one is asking the question: At what cost?” Fink said at the FII event.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| BLK | BLACKROCK INC. | 983.17 | -3.05 | -0.31% |

“Historically we were, I would say, a more consumer driven economy, that the cheapest products were the best, the most progressive way of politicking,” he continued. “Today, I think we have governmental policies that are embedded inflationary and with that being said, I think we’re not going to see interest rates as low as people are forecasting.”

Read the full article here