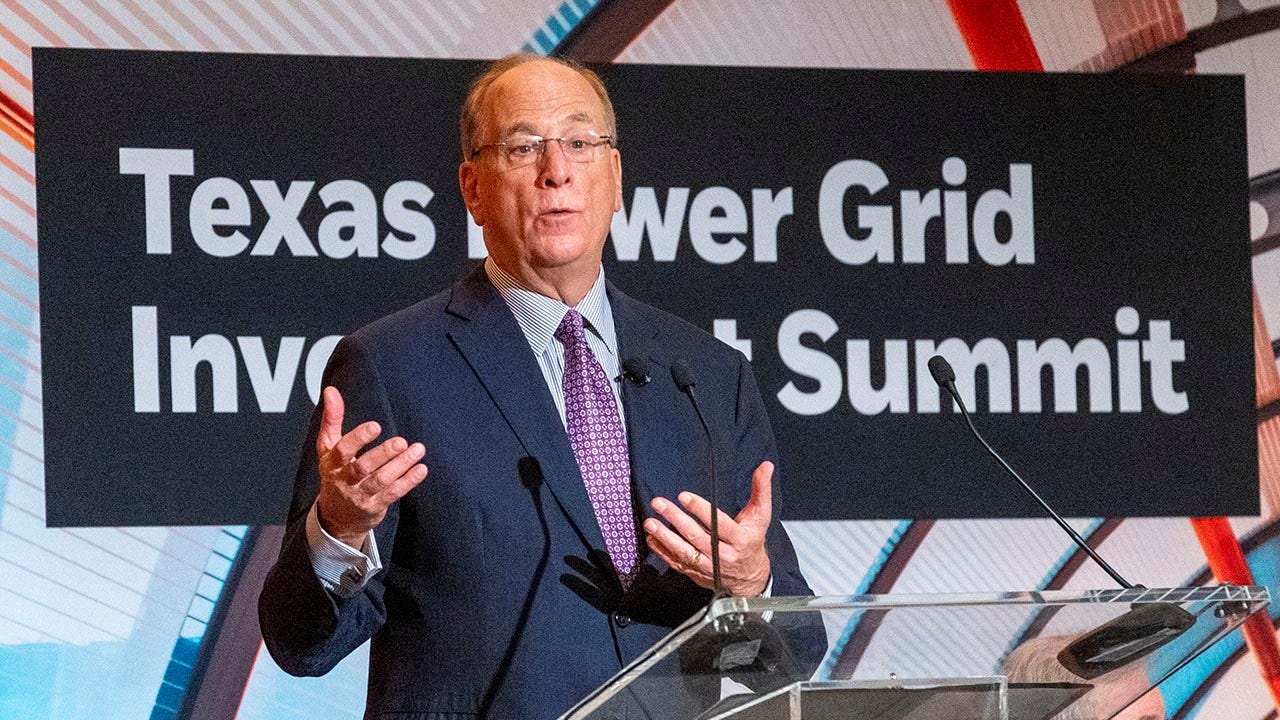

BlackRock CEO Larry Fink’s annual letter to investors continued the firm’s shift away from politically controversial topics like diversity, equity and inclusion (DEI) as well as environment, social and governance (ESG) policies.

Fink released his annual chairman’s letter to investors on Monday, and the 2025 edition of the letter omitted potentially controversial references to DEI, ESG and climate change. This comes after BlackRock in February announced a shift away from internal DEI policies and dropped such references from its annual report, instead focusing on connectivity and inclusivity.

When the annual report was released, BlackRock told FOX Business the firm is “committed to creating an environment that supports top talent and fosters diverse perspectives to avoid groupthink.”

In the letter to investors, BlackRock’s Fink included a section that touted the power of financial markets and outlined the need to expand access to portions of the market that have been closed off to many investors, as well as increasing participation in markets.

BLACKROCK FLIPS SCRIPT ON DEI POLICIES IN COMPANY-WIDE EMAIL: ‘ANNOUNCING SEVERAL CHANGES’

“Today, many countries have twin, inverted economies: one where wealth builds on wealth; another where hardship builds on hardship. The divide has reshaped our politics, our policies, even our sense of what’s possible. Protectionism has returned with force. The unspoken assumption is that capitalism didn’t work and it’s time to try something new,” Fink wrote.

“But there’s another way to look at it: Capitalism did work – just for too few people.”

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| BLK | BLACKROCK INC. | 944.84 | -0.93 | -0.10% |

“Markets, like everything humans build, aren’t perfect. They reflect us – unfinished, sometimes flawed, but always improvable. The solution isn’t to abandon markets; it’s to expand them, to finish the market democratization that began 400 years ago and let more people own a meaningful stake in the growth happening around them,” he explained.

To that end, Fink wrote that BlackRock is looking to democratize investing by helping current investors access parts of financial markets they’ve been restricted from, as well as by enabling more people to get started as investors. One of those areas is private markets, which are currently inaccessible to most investors.

BLACKROCK DROPS DEI REFERENCES FROM ANNUAL REPORT

“Most of us associate ‘markets’ with public markets – stocks, bonds, commodities,” Fink explained. “But you generally cannot buy shares in a new high-speed rail line or a next-generation power grid on the London or New York Stock Exchange. Instead, infrastructure projects are typically investable only through private markets.”

“Assets that will define the future – data centers, ports, power grids, the world’s fastest-growing private companies – aren’t available to most investors. They’re in private markets, locked behind high walls, with gates that open only for the wealthiest or largest market participants,” he wrote.

“The reason for the exclusivity has always been risk. Illiquidity. Complexity. That’s why only certain investors are allowed in. But nothing in finance is immutable. Private markets don’t have to be as risky. Or opaque. Or out of reach,” Fink said.

BLACKROCK INKS $23B DEAL FOR PANAMA CANAL PORTS

He noted that BlackRock in the past 14 months acquired two firms in fast-growing areas of private markets, including infrastructure and private credit, along with another firm with a focus on data and analytics to improve measurements of risk and spot opportunities in private markets.

Fink suggested that increased access to investing in private markets could improve investors’ portfolios through increased diversification, writing, “The beauty of investing in private markets isn’t about owning a particular bridge, tunnel, or mid-sized company. It’s how these assets complement your stocks and bonds – diversification.”

That could shift the future standard portfolio from a classic 60/40 mix of stocks and bonds, respectively, to a 50/30/20 mix of stocks, bonds and private assets — such as a mix of real estate, infrastructure and private credit, Fink wrote.

“With cleaner, more timely data, it becomes possible to index private markets just like we do now with the S&P 500. Once that happens, private markets will be accessible, simple markets. Easy to buy. Easy to track. And that means capital will flow more freely throughout the economy,” Fink explained. “The prosperity flywheel will spin faster, generating more growth – not just for the global economy or large institutional investors, but for investors of all sizes around the world.”

Read the full article here