In a bold move aimed at challenging the status quo of “woke” corporate America, Donald Trump Jr. and financier Omeed Malik are teaming up to take the online firearms retailer GrabAGun public. According to a report from the New York Post, the company—valued at $150 million—is poised to make its debut on the New York Stock Exchange with the backing of Malik’s investment firm, 1789 Capital.

Malik, known for his “contrarian” investment strategy, sees GrabAGun as the latest addition to his growing portfolio of companies thriving in what he calls the “parallel economy.” Trump Jr., who joined 1789 Capital as a special advisor in November, told the Post that the timing couldn’t be better.

“People are more concerned for their security than ever,” he said, adding that GrabAGun is emblematic of 1789’s mission to support profitable businesses ostracized by traditional financiers. “The gun space has been one of the spaces most attacked by woke corporate America.”

Despite such common attacks and financial industry pushback, GrabAGun is already profitable, pulling in more than $100 million last year. Malik’s special purpose acquisition company (SPAC), Colombier Acquisition Corp. II, will facilitate the retailer’s listing on the public market.

Empowering Second Amendment Businesses

For Trump and Malik, taking GrabAGun public is about more than financial success—it’s about defending American values. Malik’s investment philosophy rejects ESG (Environmental, Social, and Governance) mandates, instead promoting “EIG” principles: Entrepreneurship, Innovation and Growth.

“We are running towards opportunities skipped over by ESG mandates. GrabAGun is a perfect fit,” Malik told the Post.

Elon Musk also chimed in on the significance of the deal, posting on X, “The right to bear arms is what ensures America remains a democracy.”

In addition to supporting firearm sales, the partnership aims to combat financial discrimination faced by the gun industry. Traditional credit card companies increasingly refuse to process firearm transactions, labeling them high-risk. PublicSq., a company Malik previously took public, will provide payment processing technology for GrabAGun. PublicSq. caters to consumers seeking businesses committed to values like “freedom,” “family” and “the Constitution.”

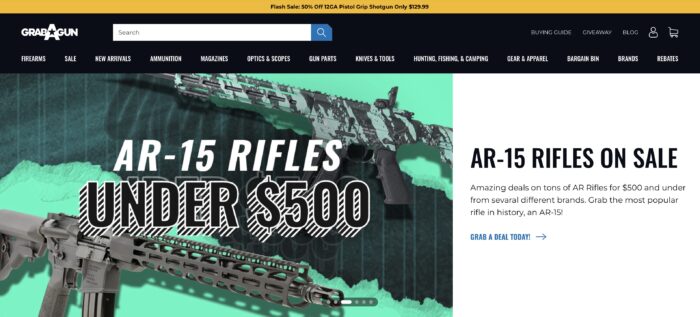

GrabAGun’s market appeal is growing among Millennials and Gen Z buyers, according to the Post article, with purchases by 18-35-year-olds increasing 57% since 2014. Trump Jr. emphasized the company’s compliance with federal background check and record-keeping requirements, adding, “The younger demographic will be able to purchase guns the way they want—online.” The company has broad appeal to price conscious gun buyers as well with promotions such as AR-15 Rifles Under $500, Shotguns Under $300, $12.99 Flat Rate Shipping for Ammo and daily GrabADeals.

As GrabAGun gears up to file its paperwork and begin its journey on the public market, Trump and Malik are confident in their strategy. Unafraid of any backlash from the broader world of finance, they’re prioritizing what they believe matters most: supporting Second Amendment rights and providing resources for Americans to exercise them, and in the process, paving the way for businesses and America to better succeed.

Read the full article here